Today I’d like to dive into the ocean of wisdom offered by one of the greatest investors of our time, Warren Buffett.

Known as the "Oracle of Omaha," Buffett's success and long-term investment strategies have made him an icon in the world of finance.

In this blog, we'll explore some valuable business advice from Warren Buffett, drawing inspiration from his speeches and taking a glimpse into his remarkable life journey.

Warren Edward Buffett was born on August 30, 1930, in Omaha, Nebraska. His passion for business and investing emerged at an early age. In one interview he recalled delivering newspapers as a young boy, filing his first tax return at 13 and claiming his bicycle as a deductible expense.

Read More

Topics:

Business Plan,

Financial Education,

business advice,

Mr. Buffet,

investment strategies,

long-term investing,

business and gain

Recently I came across an article by Dave Ramey, the financial expert and syndicated radio host, which focused on his tips for winning at business. (See link below for the full article.)

For the past two decades Dave Ramsey’s advice has been broadcast on American Television shows, radio shows and is available in print on bookshelves across the nation.

Dave Ramsey makes his money telling everyone else how to save and spend theirs. He’s helped thousands of people take control of their personal finances and saved just as many small business owners from making costly mistakes with his financial advice.

Read More

Topics:

Business Plan,

Financial Education,

business advice,

Tribe and Thrive

If the river represents cash flow to your business, what is a dam?

Simply put, the dam – and the reservoir it creates - represents cash in the bank, also known as retained earnings.

Read More

Topics:

finance,

Business Plan,

Financial Education,

cashflow

Misapplication of Economic Value Added Concept

Many companies have embraced the notion that the economic-value-added concept is superior to the traditional performance assessment measures based on traditional accounting.

Economic value added, known by the acronym EVA, is a financial measurement metric that considers the relationship between the enterprise’s profitability and the cost of the capital employed to achieve that profitability. The idea behind EVA is that managers should be evaluated in terms of how effectively, productively and profitably they employ capital in the business. To evaluate profit alone without considering the cost of the capital employed to achieve that profit can be very misleading. But if the relevant content and timing factors are not appropriately considered, EVA calculations can be as distorting and misleading as traditional profitability measures.

Read More

Topics:

financial management,

Strategic Coach,

Financial Education,

business planning,

mentorship

Ignoring the Stock Price

Companies that ignore their stock price do so at their peril.

While it is crucially important to concentrate on the basic business of the company, if a company is not mindful of what happens to its stock price, it may find it is in for a rude shock. If the stock price falls too low, investors may lose confidence in management, and critical investors may sell out. If the stock price falls too low, a takeover may happen. A company needs to pay attention both to its basic business and it its stock price.

Ignoring the company’s stock price is a mistake.

Read More

Topics:

Implementation,

Business inelligence,

Strategic Coach,

Financial Education,

entrepreneurship,

business planning,

mentorship

11 Promoting Traffic at the Expense of Profitability

Seeking to establish themselves in a new market, some companies may emphasize customer traffic—to the exclusion of whether they make any money on those so-called customers.

As Peter Drucker has observed, it is a fundamental business truth that the purpose of business is to create and retain a customer. But if you do not make any money on your customers, you do not have a business. Generating traffic without revenue and profitable customer transactions is a sure way to financial ruin. This lesson was relearned by many dot-com technology companies in the 1990s, who promoted traffic to their websites but failed to establish a viable business model. Numerous dot-com companies that failed did not sufficiently understand that, at the end of the day, maximizing hits is much less important than generating revenues in amounts more than the expenses incurred in

achieving those revenues, so that the business can make a profit and sustain itself.

Promoting customer traffic at the expense of good business is a mistake.

Read More

Topics:

Business Growth,

Systems and Processes,

success,

Strategic Coach,

Financial Education,

entrepreneurship,

business planning

1 Failing to Employ a Structured Decision Process

Decisions made without a structured, systematic process may be less than optimal.

Business school courses, academic textbooks, and training programs concerning decision making provide structured approaches, decision models, and tips to make better decisions. The classic approach involves defining the problem, identifying alternatives, undertaking quantitative analyses and qualitative assessments, exploring the risks, and then choosing the best course of action. While a structured decision making process is central to management, too often that approach is ignored.

Failing to employ a structured decision process can be a mistake.

Read More

Topics:

concepts and strategy,

Business Plan,

Strategic Coach,

Financial Education,

entrepreneurship,

identify your why

Image Credit: Duhaime Law http://www.duhaime.org

We received calls from four different attorneys from disparate parts of the country this past month. Actually, one attorney was from British Columbia, Canada. It boiled down to the inability to expect retirement as a reality.

Each in their own way, they told me that they were looking forward. You know, forecasting. And, they realized that although they wanted to retire someday, not one of them thought retirement was unlikely. They wouldn’t be able to accumulate the required wealth they need to do so. Two were in their third decade of practice, one aged 39, and one just starting out. They were all small practice attorneys.

Read More

Topics:

concepts and strategy,

content creation,

Financial Education,

Marketing education

Why 2019 Is eLaunchers’ Year Of

Independence and Freedom

This July 4th is the celebration of my 20th anniversary of making a life here in this land of the free, home of the brave. I came to the realization this holiday weekend that I am significantly fortunate to live in the United States, and I am proud to be an American.

Read More

Topics:

value added,

Business inelligence,

elaunchers,

customer experience,

content creation,

No BS,

Continuing Education,

Financial Education

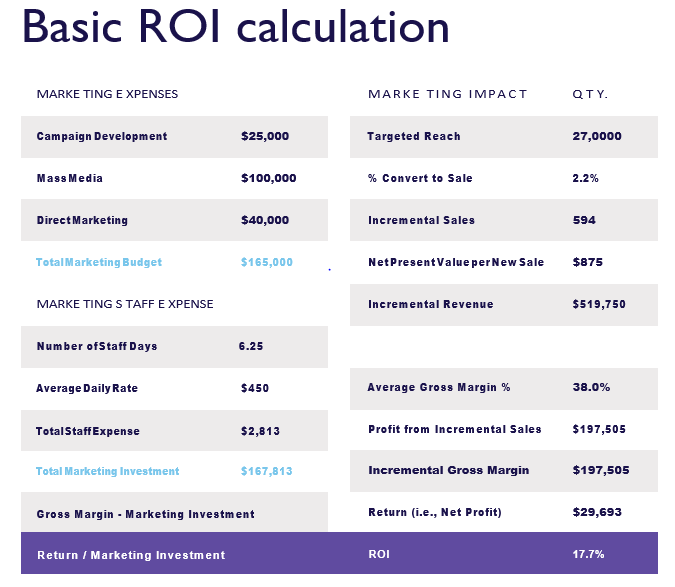

The value of marketing metrics is critical to a firm’s interests, especially knowing where the revenues originate, flow through the department and produce the ROI that the C-Suite is always asking of marketers large and small.

If you are not measuring what you are doing concerning marketing and budgeting, you should consider other work. The future will become more and more dependent upon measurement as revenues relate to CPM (cost per man/hour), stock ratio, as a percentage of the overall gross profit, and on and on and on.

Read More

Topics:

financial management,

Financial Education,

Technology