I pride myself on being a constant student.

I am constantly researching how to sell more, how to be more strategic in business and how to get better results for my clients.

Over the years, I’ve developed tested and proven strategies that make my clients money.

If you are looking to gain market share—I can help.

Read More

Topics:

marketing automation,

finance

Today’s blog will focus on Steve Jobs, the visionary entrepreneur, and one of my personal heroes.

His story as the self-made man and later as the comeback kid are an inspiration to anyone looking to make their mark on this planet.

This is a man who was raised by working class parents, who dropped out of college, Co-Founded Apple in his garage, worked hard and ten years later headed a Company worth over $2Billion with over 4,000 employees.

Then, the company he helped created fired him.

Read More

Topics:

marketing automation,

finance,

business growth strategy,

an inspiration,

entrepreneur

If the river represents cash flow to your business, what is a dam?

Simply put, the dam – and the reservoir it creates - represents cash in the bank, also known as retained earnings.

Read More

Topics:

finance,

Business Plan,

Financial Education,

cashflow

It was 8 p.m. on a Friday night and I out with some friends. We were sitting around a table and chatting. At some point, it became a bragging contest where we were essentially trying to outdo each other. My friends and I went back and forth for a little while. Finally, I said, if there was a sweet deal on the table tonight, then I could have more than a million dollars in cash in this house by midnight. Suffice to say that I won our playful argument. Cash to a business is like oxygen to a human. You lose cash and you die. It has nothing to do with your potential, valuation, the value of an intellectual property or physical inventory.

Read More

Topics:

finance,

Business Growth,

Dan Kennedy,

Marketing education,

business planning

In my relentless search for I don't know what, I found an article in the December 1, 2008 edition of Nation's Restaurant News, the trade journal of the restaurant industry, headlined: "Operators Bank On Profit And Loss Scrutiny To Stay Afloat." It made me laugh out loud. The article states that "maximizing the profit and loss statement has become a mantra for restaurant operators during the current economic downturn."

This is then presented as some sort of horrific torture imposed on the owners by a vicious economy. What is not said, but should be, is that maximizing profit shouldn't be paid attention to only after dire economic conditions occur, to be given temporary priority, only until 'things get better.' It's supposed to be what anybody responsible for operating a business does everyday. Including what's then described in the article: ferreting out and cutting wasteful spending, controlling labor and administrative costs; creating products, offers and price propositions customers really want. Any business owner complaining about having to attend to these priorities because of a recession is a moron, and any trade-journal writer taking them seriously is dumber than a sandbox.

Read More

Topics:

finance,

Business Growth,

Business Plan

Wait. Cost of Sale? Don’t sales make us money? How can it cost us? Coming from the hypothesis that God does not make direct deposits, the fact that they gold rush is over, bitcoin possibly but it’s up in the air, and stealing is unacceptable -- getting money effortlessly is nearly impossible. It takes effort to turn prospects into long-term customers. You must focus on generating awareness, establishing trust, building a relationship, and creating a conducive environment where people are ready to buy from you.

Read More

Topics:

Blog,

profit,

finance,

fiscal responsibility

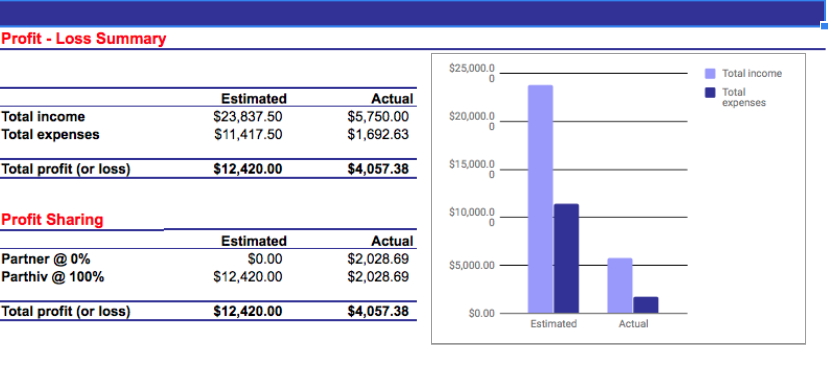

A few posts ago, we talked about project P&L. To quickly recap the concept behind project P&L is let me give an example regarding fixed fee projects:

If I ask a client for $10,000, then I will do X. If they give me $1000, then I will do Y. If I ask for $45,000, then they will get the Z package. For each package, there is a finite scope of work. I give them the scope and then the either sign or don’t sign the deal. But it is not always that simple. Sometimes, it takes me longer to do what I said I will do. Sometimes, I underestimate the needs of the project and I have to do a lot more than I originally estimated.

Read More

Topics:

Blog,

profit,

finance,

fiscal responsibility

When my son was eleven years old, I had a conversation with him about accountability. I was telling him that in economics, everyone must carry their weight and pay for their own way in the world. He was drinking milk and eating toast while I was practically ranting to him about the state of the world. When I started arguing that it was not fair for over-performing assets to subsidize underperforming assets and non-performing liabilities, he put his mug down and exclaimed, “I should stop drinking this milk then.”

Read More

Topics:

Blog,

finance,

fiscal responsibility

As a data scientist, numbers do not scare me. In fact, I love numbers. When those numbers have a dollar signed attached to them, I love them even more. Money and data go hand-in-hand. In the business world, the best thing to keep track of finances is a profit and loss (P&L) chart. This is also known as the common accounting practice of job costing.

Read More

Topics:

Blog,

finance,

fiscal responsibility,

P&L

It was eight p.m. on a Friday night and I was out with some friends. We were sitting around a table and chatting. At some point, it became a bragging contest where we were essentially trying to outdo each other. My friends and I went back and forth for a little while. Finally I said, if there was a sweet deal on the table tonight, then I could have more than a million dollars in cash in this house by midnight. Suffice enough to say that I won our playful argument.

Read More

Topics:

Blog,

finance,

fiscal responsibility